These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.

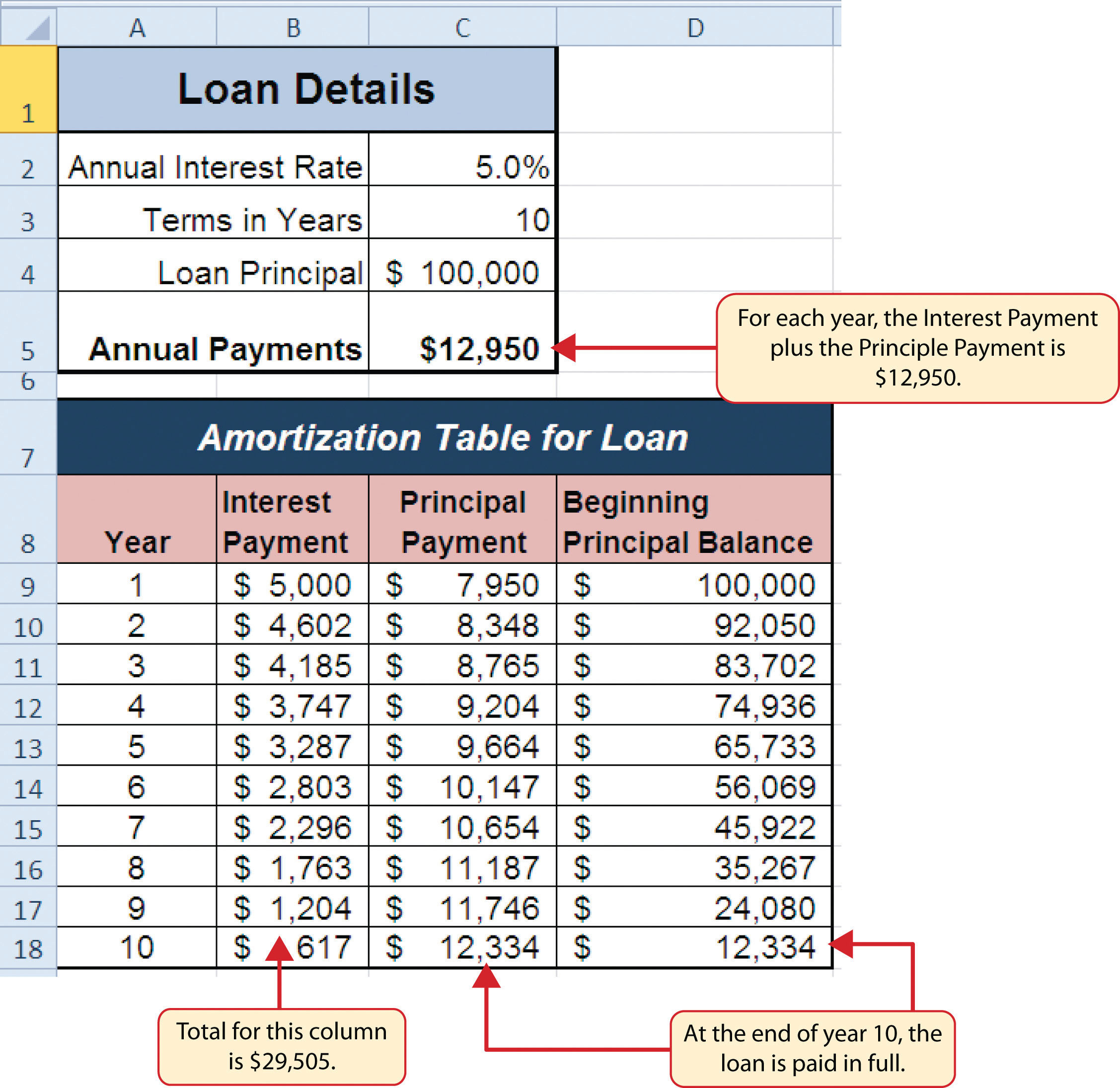

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. This training introduces you to Power BI and delves into the statistical concepts that will help you devise insights from available data to present your findings using executive-level dashboards.We strive to provide you with information about products and services you might find interesting and useful. This Business Analytics certification course course teaches you the basic concepts of data analysis and statistics to help data-driven decision making. The table is very useful in calculating the regular payments.īoost your analytics career with powerful new Microsoft Excel skills by taking the Business Analytics with Excel course, which includes Power BI training In this article, we made the amortization loan schedule table and understood how the different functions work. To find the balance after the first payment in cell E8, you will need to add up/combine the loan amount (C5) and the principal of the first period (D8).īecause a loan amount is a positive number and the principal is a negative number, the principal is subtracted from the loan amount.įor the second and all periods succeeding this, you can add up the previous balance and the first period's principal to get the required result.

There are two different formulas to calculate the remaining balance.

0 kommentar(er)

0 kommentar(er)